SmartAsset Investment Calculator offers a user-friendly platform for projecting investment outcomes. This tool allows users to input personal financial data, including age, income, and risk tolerance, to receive personalized investment recommendations across various asset classes such as stocks, bonds, and real estate. Understanding its capabilities and limitations is crucial for investors seeking to leverage technology for informed financial decisions.

The calculator’s methodology, based on established financial principles, aims to provide realistic projections. However, like all financial models, it relies on assumptions and estimations, making it essential to understand the potential limitations and biases inherent in the projections. This review will delve into the SmartAsset Investment Calculator’s features, comparing it to competitors, and exploring its accuracy, user experience, and data security practices.

We will also examine various investment scenarios to illustrate its application and limitations.

SmartAsset Investment Calculator: A Comprehensive Review

SmartAsset’s Investment Calculator is a free online tool designed to help users create a personalized investment plan based on their financial goals, risk tolerance, and time horizon. This review delves into its functionality, accuracy, user experience, and compares it to other popular investment calculators.

SmartAsset Investment Calculator Overview

The SmartAsset Investment Calculator provides users with a projected investment portfolio allocation based on their individual circumstances. It handles various investment types, including stocks, bonds, and real estate, though the specific weighting of these asset classes depends heavily on the user’s input.

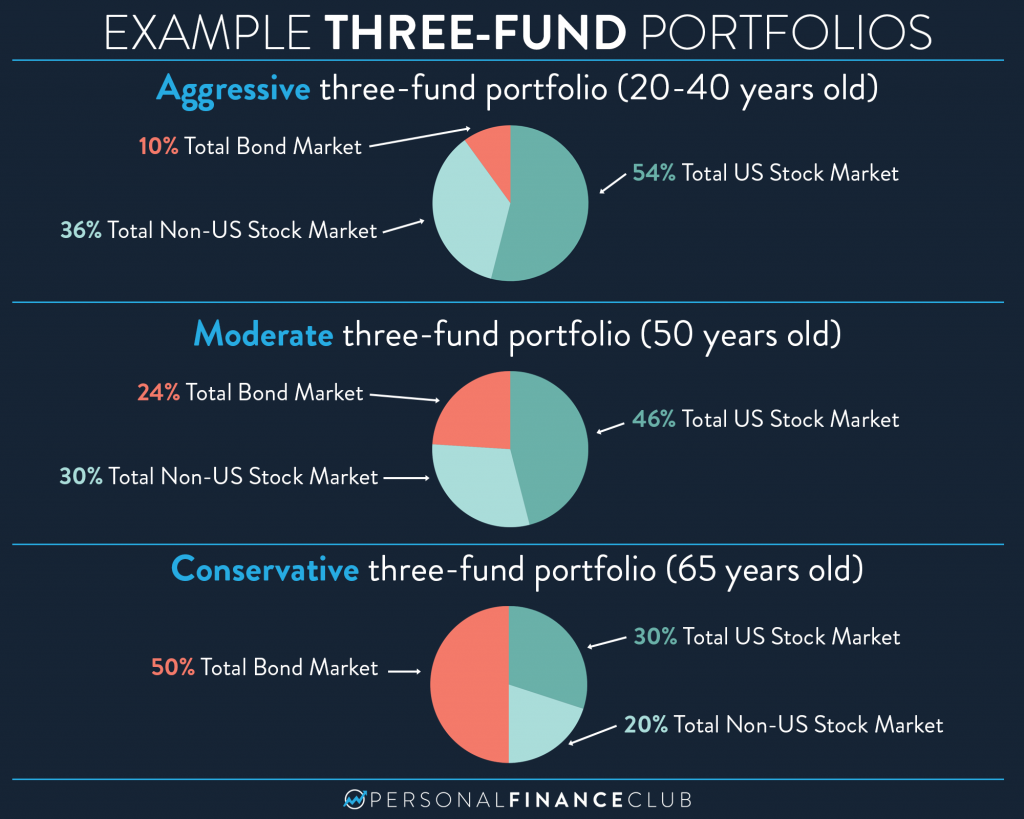

The calculator requires users to input several key parameters: age, income, net worth, investment goals (e.g., retirement, down payment), risk tolerance (conservative, moderate, aggressive), and investment timeframe. By combining this information, the calculator generates a suggested portfolio allocation and estimated returns.

Using the SmartAsset Investment Calculator is straightforward. The following table Artikels the step-by-step process:

| Step | Action | Input Required | Expected Output |

|---|---|---|---|

| 1 | Access the SmartAsset Investment Calculator | None | Calculator interface |

| 2 | Enter Personal Information | Age, income, net worth, investment goal, time horizon | Validation of input and proceeding to the next step |

| 3 | Select Risk Tolerance | Conservative, Moderate, or Aggressive | Updated portfolio allocation based on risk selection |

| 4 | Review Portfolio Allocation | None | Suggested asset allocation (stocks, bonds, etc.) and projected returns |

Comparison with Other Investment Calculators

Several other investment calculators exist, each with its own strengths and weaknesses. Comparing SmartAsset’s calculator to Fidelity’s and Vanguard’s tools reveals key differences:

- SmartAsset: Focuses on providing a personalized portfolio allocation with an emphasis on visual representation of results. It’s user-friendly but may lack the depth of analysis found in other tools.

- Fidelity: Offers a broader range of tools and resources beyond simple portfolio allocation, including retirement planning and tax optimization features. It may be more complex for novice investors.

- Vanguard: Similar to Fidelity in its comprehensive approach, emphasizing its own range of investment products. Its strength lies in its integration with Vanguard’s investment platform.

SmartAsset’s key differentiating feature is its user-friendly interface and clear presentation of results. While less comprehensive than Fidelity or Vanguard, it excels in its simplicity and ease of use for those new to investing.

Advantages include its accessibility and ease of use, while disadvantages include a potentially less nuanced approach to portfolio allocation compared to more comprehensive tools.

Accuracy and Reliability

The SmartAsset Investment Calculator uses established financial models and algorithms to generate investment projections. However, the accuracy of these projections depends heavily on the accuracy of the user’s input and the inherent volatility of the financial markets. The calculator’s methodology likely involves Monte Carlo simulations or similar techniques to account for market fluctuations.

Factors influencing accuracy include market conditions, inflation rates, and the user’s actual investment performance (which can deviate from projections). The calculator’s projections should be considered estimates rather than guaranteed outcomes.

Potential limitations include its inability to account for unforeseen events (e.g., economic recessions, unexpected market crashes) and its reliance on historical data, which may not accurately predict future performance. The calculator may also exhibit biases depending on the underlying algorithms and data used.

User Experience and Interface

Source: personalfinanceclub.com

SmartAsset’s investment calculator offers users a powerful tool for projecting future portfolio growth. Understanding the nuances of long-term investment strategies, however, often requires additional research, such as exploring resources like the comprehensive analysis available at wcoanimr , which provides valuable insights into market trends. Returning to SmartAsset, remember that the calculator’s projections are estimates and should be considered alongside broader financial planning.

The SmartAsset Investment Calculator boasts a clean and intuitive interface, making it easy to navigate and understand, even for users with limited financial knowledge. The visual presentation of results is a strong point, with clear charts and graphs that illustrate the projected portfolio allocation and returns.

Potential design improvements could include adding more granular control over investment choices (e.g., allowing users to specify individual stocks or bonds) and incorporating interactive elements to allow users to explore different scenarios more easily. Improving accessibility features for users with disabilities would also be beneficial.

The overall visual appeal is modern and straightforward, avoiding overwhelming users with unnecessary complexity. The calculator’s design is consistent with the overall SmartAsset branding.

Data Security and Privacy

SmartAsset’s website employs standard security measures, such as HTTPS encryption, to protect user data transmitted to and from their servers. Their privacy policy Artikels how user data is collected, used, and protected. Users should carefully review this policy before using the calculator.

SmartAsset’s privacy policy likely details the types of data collected, how it is used, and with whom it may be shared (if at all). It should also Artikel users’ rights regarding their data.

Potential risks associated with providing personal financial information online include data breaches and identity theft. Users should only use reputable websites and calculators and be cautious about sharing sensitive information.

Illustrative Investment Scenarios, Smartasset Investment Calculator

The following table illustrates three different investment scenarios using the SmartAsset Investment Calculator, showcasing the impact of varying risk tolerance on projected returns:

| Scenario | Investment Strategy | Projected Returns (Illustrative) | Risk Level |

|---|---|---|---|

| Conservative | Primarily bonds and low-risk investments | 3-5% annualized return | Low |

| Moderate | Balanced mix of stocks and bonds | 6-8% annualized return | Medium |

| Aggressive | Heavily weighted towards stocks and potentially alternative investments | 8-12% annualized return (with higher volatility) | High |

These projections are illustrative and depend on several assumptions, including consistent market performance and adherence to the chosen investment strategy. Changes in input parameters, such as age or risk tolerance, would significantly alter the recommended portfolio allocation and projected returns.

Potential Applications and Limitations

The SmartAsset Investment Calculator has several practical applications, but also limitations to consider:

- Applications: Retirement planning, determining investment allocation for specific goals (e.g., down payment, education), assessing the impact of different risk tolerances on investment outcomes.

- Limitations: Inability to account for specific tax implications, lack of personalized financial advice, reliance on historical data which may not predict future performance accurately, does not consider individual circumstances beyond basic inputs.

Ultimate Conclusion

The SmartAsset Investment Calculator provides a valuable tool for individuals seeking to visualize potential investment outcomes. While offering a user-friendly interface and personalized recommendations, users should remember that the projections are based on models and assumptions, and professional financial advice remains crucial for making informed investment decisions. Understanding its strengths and limitations, coupled with careful consideration of personal circumstances, allows users to maximize the benefits of this technological aid in their financial planning.